MONROE COUNTY RESPONDS TO FEMA REGARDING NATIONAL FLOOD INSURANCE PROGRAM NATIONAL VIOLATION TRACKER

MONROE COUNTY, FL – On Aug. 7, Monroe County received a letter from FEMA regarding its finding for the National Flood Insurance Program (NFIP) Community Assistance Visit (CAV). The visit aimed to determine the effectiveness of Monroe County’s floodplain management program as required for participation in the NFIP. Monroe County is currently a Class 3 in the Community Rating System (CRS), which shows the County’s dedication to higher standards and reflects a deep discount in flood insurance rates for unincorporated Monroe County NFIP flood insurance policyholders.

MONROE COUNTY, FL – On Aug. 7, Monroe County received a letter from FEMA regarding its finding for the National Flood Insurance Program (NFIP) Community Assistance Visit (CAV). The visit aimed to determine the effectiveness of Monroe County’s floodplain management program as required for participation in the NFIP. Monroe County is currently a Class 3 in the Community Rating System (CRS), which shows the County’s dedication to higher standards and reflects a deep discount in flood insurance rates for unincorporated Monroe County NFIP flood insurance policyholders.

Findings from the CAV for the floodplain management program included no identifiable problems with the floodplain ordinance and that the current ordinance meets the minimum standards of the NFIP. Due to the County’s high standards, there were no findings that revealed any recent violations of the floodplain regulations, but it did show more than 1,900 structures in unincorporated Monroe County listed on the National Violation Tracker that could have a potential compliance issue. These potential violations are made up of structures rated a foot or more below base flood elevation. FEMA initially raised its concerns with the NVT list when the County brought forward questions about changing rules in the floodplain ordinance, including eliminating the restriction that limits downstairs enclosures to no more than 299 square feet.

Per FEMA’s request, on Aug. 17, Monroe County submitted a plan of action to research the structures listed on the NVT list and determine if violations exist.

“We have begun work to develop a comprehensive action plan with a commitment of resources and proposed schedule to address the outstanding potential floodplain concerns currently listed in FEMA’s National Violation Tracker,” said Monroe County Building Official and Floodplain Administrator Rick Griffin. “Our preliminary analysis shows the number of properties listed on the NVT can likely be substantially reduced with submission to FEMA of documentation and information showing compliant structures.”

The structures listed may comply due to being floodproofed (commercial), found in compliance with previously passed inspections, issued a Letter of Map Change, demolished, or located outside Monroe County’s jurisdiction. In addition, some of the addresses could be on the list due to erroneous elevation certificates or inaccurate insurance reporting.

The County will proceed with an action plan for properties not compliant with the NVT list. A more detailed action plan is expected to be submitted to FEMA by Sept. 30, 2023.

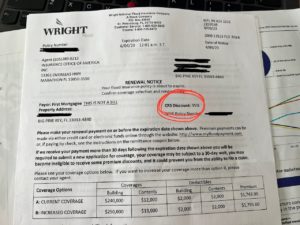

Of the 1,913 properties on the list, property owners who think their property may be on the NVT list may see an indicator on their NFIP flood insurance bill if it shows a zero percent discount under the CRS discount. Unincorporated Monroe County NFIP flood insurance policyholders see a 35 percent discount on their policies (see attachment). If you see a zero, contact your insurance agent for more details on why a lesser discount is shown. This is only for unincorporated Monroe County and not for those who live within a city.

The County is still developing the next steps, including seeing which properties can be removed from the list that are not in violation. Details for properties that may be in violation will be decided in the future.

To learn more about the CRS and how it works, visit https://agents.floodsmart.gov/sites/default/files/fema-nfip-crs-guide-2023.pdf.

[livemarket market_name="KONK Life LiveMarket" limit=3 category=“” show_signup=0 show_more=0]

No Comment