CRS CLASS 3 DISCOUNTS TAKE EFFECT FOR UNINCORPORATED MONROE COUNTY; RISK RATING 2.0 INFORMATION

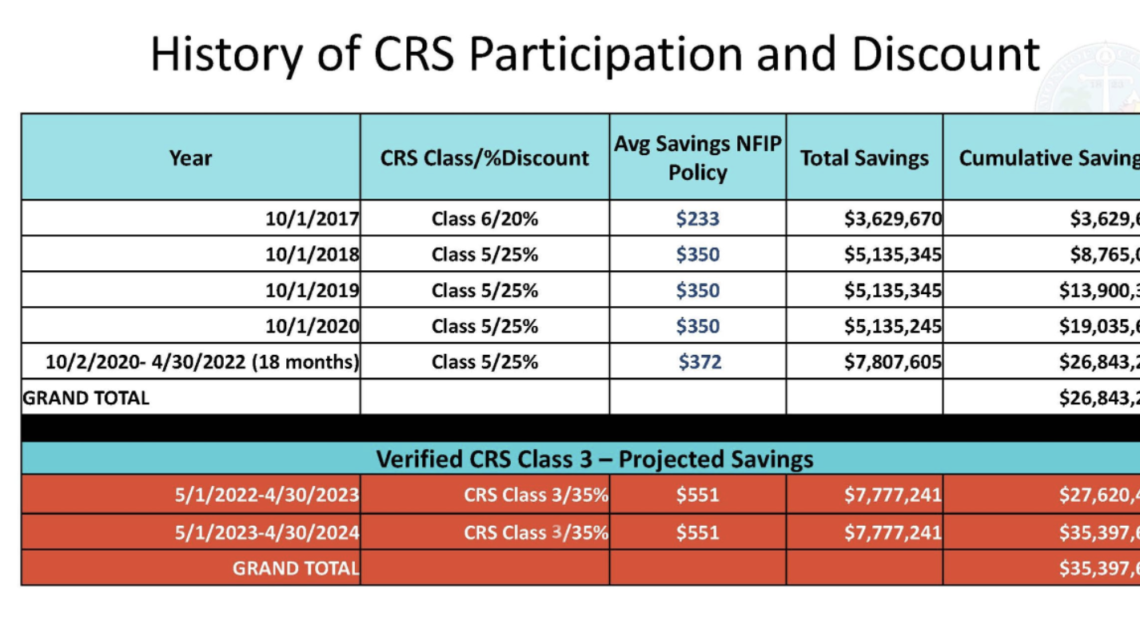

MONROE COUNTY, FL – Through the accomplishments of staff and Monroe County’s Community Rating System (CRS) consultant Lori Lehr, National Flood Insurance Program (NFIP) policyholders in unincorporated Monroe County will see a 35 percent discount as policies renew. Taking effect April 1, 2022, the Class 3 rating for Monroe County increases annual savings to flood insurance for 14,123 policyholders in unincorporated Monroe County to $7.8 million annually. There will be an average annual savings of about $551 per policyholder. Cumulatively to date, the County has saved policyholders approximately $26.8 million by its participation in this program.

“Unincorporated Monroe County joined a very elite group of other communities in a Class 3 or lower designation,” said Emily Schemper, Director of Planning and Environmental Services. More information on the local CRS program can be found at www.monroecounty-fl.gov/crs.

The CRS program is important because the Federal Emergency Management Agency’s (FEMA) Flood Risk Rating 2.0 will affect most Florida Keys NFIP policyholders. FEMA fundamentally changed how it will rate a property’s flood insurance risk and prices with its Risk Rating 2.0 methodology. Current NFIP policyholders throughout Monroe County will see changes in their policy when renewed. Flood Risk Rating 2.0 is a nationwide FEMA initiative, not just in Monroe County. Monroe County. Monroe County’s participation in the CRS may help offset some of the increases policyholders in unincorporated areas will see from Risk Rating 2.0.

In 2021, there were 30,799 active NFIP policies throughout Monroe County per FEMA’s data. According to FEMA’s data, 90.9 percent of policyholders will see an increase, and 9.1 percent will see a reduction or no change. Individual policyholders should contact their insurance agent about how this will affect their premium.

“The impacts of Risk Rating 2.0 are heavily skewed against coastal communities. The County will continue to be a part of the nationwide discussion and its effects on Monroe County policyholders,” said Monroe County Legislative Affairs Director Lisa Tennyson. “Protecting affordable flood insurance is the number one federal legislative priority for Monroe County and has been since the Biggert-Waters reform in 2012.”

FEMA’s new methodology for determining NFIP policy premiums reflects a property’s individual flood risk, including the frequency and types of flooding, such as storm surge, coastal erosion, and heavy rainfall — and the distance to a water source along with property characteristics, such as elevation and the cost to rebuild. An elevation certificate on file with your insurance agent may help in some cases.

Per federal statutes, NFIP, a federal program, caps annual increases at 18 percent for primary residential properties and 25 percent for second homes and commercial properties. Risk Rating 2.0 increases cannot exceed the rate caps; however, Tennyson stresses that the current annual rate caps are already unaffordable for most Monroe County homeowners.

“Nationwide, the average policy is about $800; in the Florida Keys, people pay $3,000, $4,000, $5,000 for their policies. Annual rate increases of 18 percent are unstainable,” she said. “Monroe County’s main focus continues to be on lowering the rate caps to under 10 percent.”

With a maximum benefit of $250,000, the actual beneficiaries of this program are working and middle-income homeowners and commercial property owners in coastal communities. Most multi-million-dollar homes in coastal areas are privately insured.

FEMA’s zip code data for existing single-family home policies can be found at no.floods.org/rr2sfh. More information on FEMA’s program can be found at https://www.fema.gov/flood-insurance/risk-rating.

[livemarket market_name="KONK Life LiveMarket" limit=3 category=“” show_signup=0 show_more=0]

No Comment